Some Known Details About Offshore Banking

Table of ContentsThe Ultimate Guide To Offshore BankingAn Unbiased View of Offshore BankingSome Known Facts About Offshore Banking.Offshore Banking Things To Know Before You Get ThisSome Of Offshore BankingThe smart Trick of Offshore Banking That Nobody is DiscussingThe Ultimate Guide To Offshore BankingOffshore Banking Can Be Fun For AnyoneThe Ultimate Guide To Offshore Banking

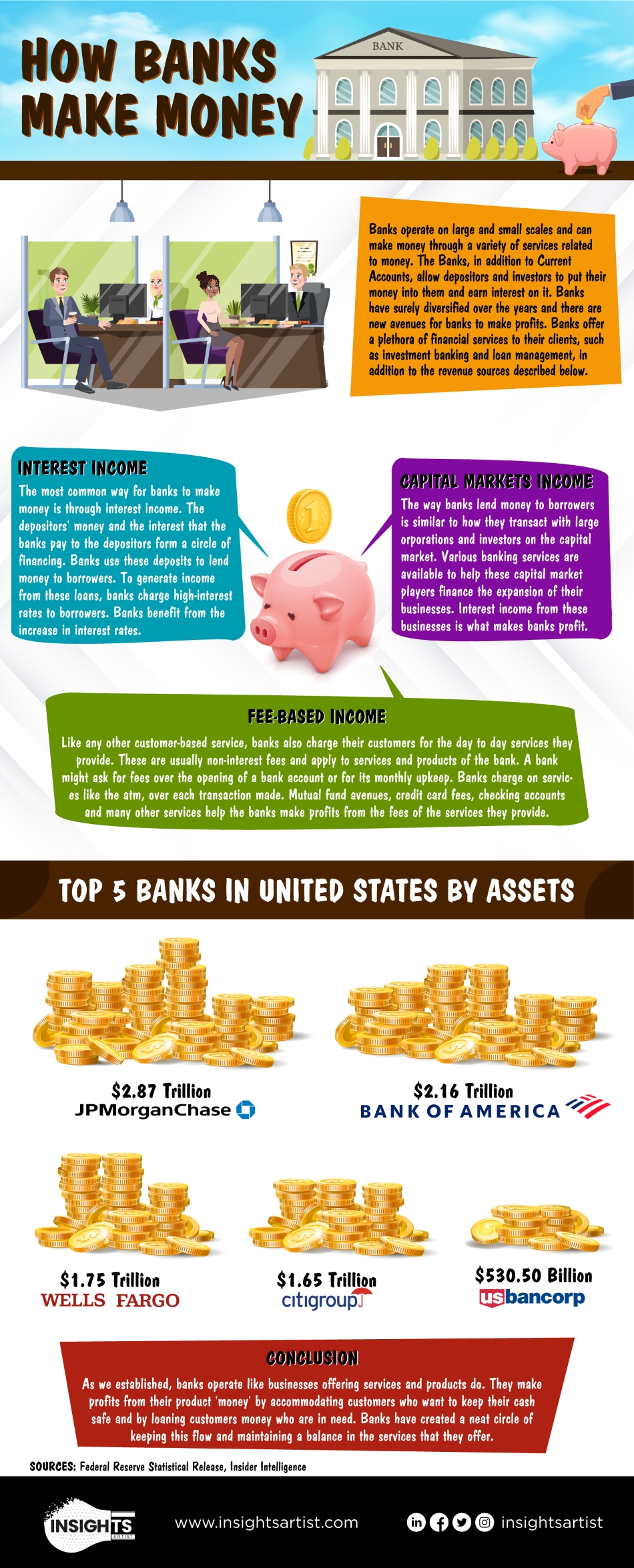

Banks do this by billing more passion on the finances as well as other debt they provide to debtors than what they pay to people that use their financial savings vehicles.

The smart Trick of Offshore Banking That Nobody is Talking About

Financial institutions earn a profit by charging even more rate of interest to customers than they pay on interest-bearing accounts. A bank's dimension is determined by where it lies and also that it servesfrom tiny, community-based establishments to huge business banks. According to the FDIC, there were just over 4,200 FDIC-insured commercial banks in the United States since 2021.

Convenience, rate of interest prices, as well as charges are some of the factors that assist customers decide their preferred financial institutions.

Some Ideas on Offshore Banking You Should Know

You need to think about whether you want to keep both organization as well as personal accounts at the same financial institution, or whether you desire them at different financial institutions. A retail financial institution, which has standard financial solutions for clients, is the most ideal for daily banking. You can select a standard bank, which has a physical building, or an online bank if you don't desire or need to physically visit a financial institution branch.

A community bank, for instance, takes deposits and lends locally, which might offer an extra tailored financial partnership. Choose a practical area if you are choosing a financial institution with a brick-and-mortar area. If you have a financial emergency, you do not intend to have to take a trip a cross country to get money.

Not known Details About Offshore Banking

Some banks likewise provide smart device applications, which can be helpful. Some big banks are moving to finish overdraft fees in 2022, so that might be a vital consideration.

After making some limited reductions (in the form of commission), the bank foots the bill's worth to the owner. When the costs of exchange grows, the financial institution gets its payment from the celebration, which had actually approved the bill. Financial institutions offer cheque pads to the account owners. Account-holders can draw cheques upon the financial institution to pay money.

Offshore Banking for Dummies

Financial institutions aid their customers in transferring funds from one location to one more via cheques, drafts, and so on. A charge card is a card that permits its owners to make purchases of items and also services for the charge card's provider promptly spending for the items or service. The cardholder debenture back the acquisition total up to the card provider over time and also with passion.

Mobile banking (likewise called M-Banking) is a term utilized for carrying out balance checks, account transactions, repayments, credit report applications, and also various other banking purchases via a mobile phone such as a mobile phone or Personal Digital Assistant (PERSONAL ORGANIZER), Accepting down payments from savers or account holders is the main function of a bank.

Offshore Banking Can Be Fun For Everyone

People favor to deposit their savings in a bank since by doing so, they gain rate of interest. Priority financial can include a number of numerous services, but some preferred ones consist of free monitoring, online costs pay, monetary consultation, and also info. Personalized economic and banking solutions are generally offered to a bank's electronic, high-net-worth individuals (HNWIs).

Private Banks intend to match such people with the most appropriate choices. offshore banking.

Get This Report on Offshore Banking

Not just are cash market accounts Federal Deposit Insurance Corporation-insured, however they make greater i loved this rate of interest than inspecting accounts. Cash market accounts reduce the danger of investing due to the fact that you always have access to your money you can withdraw it at any moment scot-free, though there may some restrictions on the number of deals you can make every month - offshore banking.

Business banking generally provides higher revenues for financial institutions as a result of the huge amounts of money and rate of interest entailed with corporate loans. Occasionally both departments overlap in terms of their services, yet the actual distinction remains in the clients as well as the profits each financial type makes. A organization banker works closely with clients to identify which financial services and products best fit their needs, such as organization bank account, credit report cards, treasury administration, car loans, even settlement processing.

Offshore Banking Things To Know Before You Buy

You wish to pick a financial institution that uses a complete series of solutions so it supports your financial needs as your organization expands. Here are several of the attributes to search for. ACH allows money to helpful resources be moved electronically without using paper checks, cord transfers or money. It can be made use of for both payables check here as well as receivables.